Managing finances can be challenging, especially when unexpected expenses arise. Many people live paycheck to paycheck, and a sudden car repair or medical bill can throw their budget into disarray. Traditional payday loans can be predatory, with high interest rates, leading to a cycle of debt that’s hard to escape. In 2024, it’s reported that 60% of Americans don’t have enough savings to cover a $1,000 emergency expense, highlighting the widespread financial instability many face.

Imagine being hit with an unexpected bill a week before your paycheck is due. You don’t have enough savings to cover it, and your bank charges exorbitant overdraft fees. The stress and anxiety of not knowing how to make ends meet can be overwhelming. You might look out for apps to borrow money. According to recent statistics, overdraft fees in the U.S. reached an average of $33.58 per transaction in 2024, further burdening those already struggling. You need a solution that’s quick, reliable and doesn’t trap you in a cycle of debt.

Thankfully, there are innovative cash advance apps like Dave designed to help you bridge the gap between paychecks without the high costs and hassle of traditional payday loans. In fact, usage of cash advance apps has surged by 45% in 2024 as more people seek safer financial alternatives.

Here are the 10 best cash advance apps like Dave in 2024 that provide a lifeline during financial emergencies. These apps offer low fees, easy access, and flexible repayment options, giving you peace of mind when you need it most. Say goodbye to financial stress and hello to a more secure way to manage your money with these top-rated cash advance solutions.

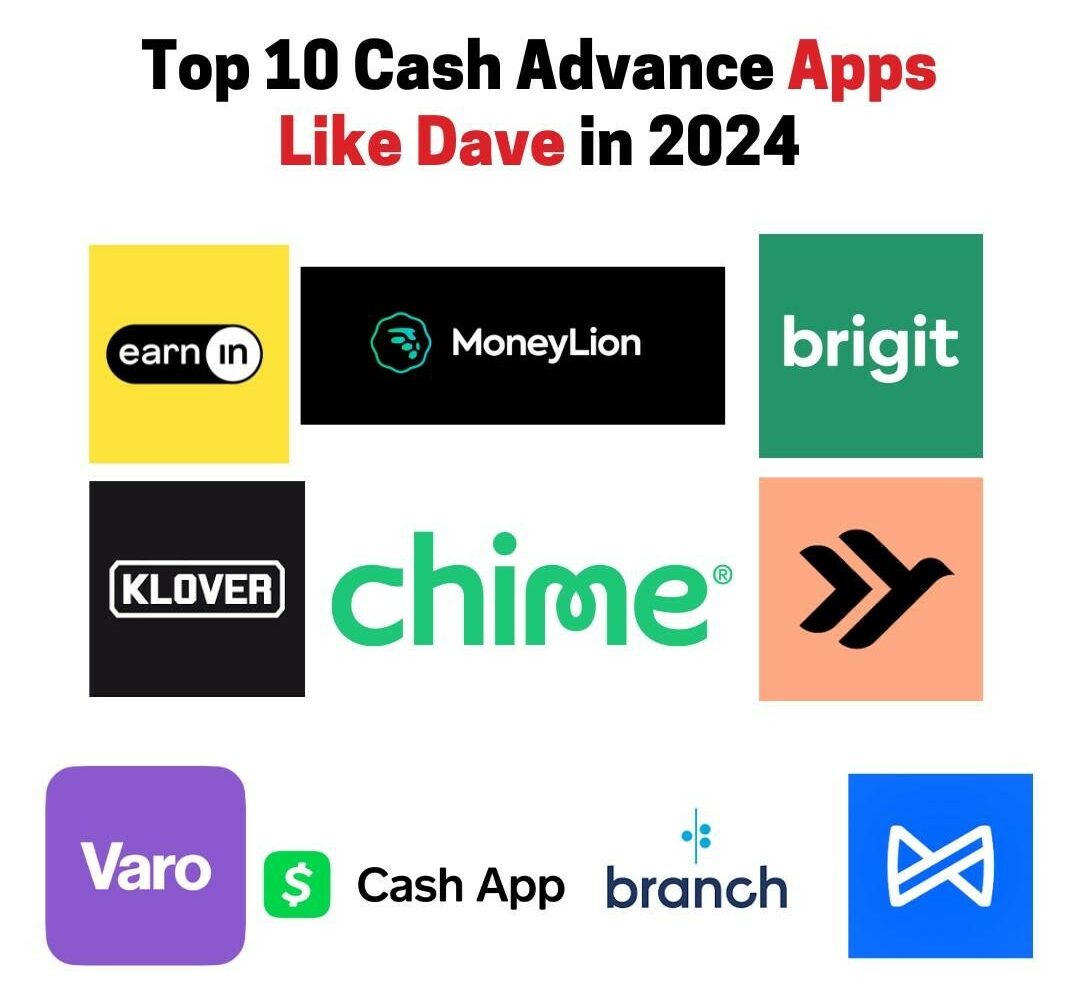

Top 10 Cash Advance Apps Like Dave in 2024

The top ten cash advance apps like Dave are:

- Earnin

- MoneyLion

- Brigit

- Klover

- Empower

- Chime SpotMe

- Varo Advance

- Cash App

- Branch

- Albert

Let’s explore the top 10 cash advance apps like Dave in 2024, highlighting their features, pricing models, and the latest statistics to help you make an informed choice for managing your finances.

1. Earnin

Earnin focuses on providing access to your earned wages. It boasts a “tip” system instead of fees, allowing you to determine how much you want to pay for the service, just as apps like Dave. This app also offers features like overdraft protection and financial wellness tools. However, unlike Dave, Earnin does not offer budgeting or side hustle opportunities.

Free Features

- Access to earned wages

- Overdraft protection

- Financial wellness tools

Paid Features

- “Tip” system (voluntary payment, not mandatory)

- Higher cash advance limits based on usage and tipping history

Why Earnin?

- Over 5 million downloads on the Google Play Store.

- User Rating: 4.5 stars on the Google Play Store from 260,000+ reviews.

- Raised $190 million in total funding.

2. MoneyLion – Cash Advance Apps Like Dave

MoneyLion goes beyond just cash advances. It offers a comprehensive financial platform with features like a managed investment account, a credit-building tool, and (of course) cash advance. Their cash advance limit is higher than Dave’s, but MoneyLion may charge membership fees and transaction fees depending on the chosen service tier. Moneylion ranks as the most favorite in instant cash advance apps like Dave.

Free Features

- Cash advances

- Financial tracking and spending insights

Paid Features

- Managed investment account

- Credit-building tool

- Membership fees (vary by service tier)

- Transaction fees for certain services

- Higher cash advance limits

Why MoneyLion?

3. Brigit – Money Lending Apps Like Dave

Brigit focuses on helping users avoid overdraft fees. They offer a “Free” plan with a small advance limit and a “Plus” plan with a higher limit and additional features like budgeting tools and credit builder. While Brigit’s advance limits are lower than Dave’s, it stands out for its focus on preventing overdrafts, a common financial pitfall.

Free Features

- Small advance limit

- Basic financial tracking

Paid Features (Plus Plan)

- Higher cash advance limit

- Budgeting tools

- Credit builder

- Overdraft protection

Why Brigit

4. Klover – Instant Cash Advance Apps Like Dave

Klover offers instant cash advance up to $200. Unlike Dave, Klover charges a monthly subscription fee. Additionally, they offer a sweepstakes feature where users can win a chance to increase their advance amount.

Free Features

- Instant cash advance up to $200

Paid Features

- Monthly subscription fee

- Sweepstakes feature to increase advance amount

- Financial insights and tools

Why Klover

5. Empower – Borrowing Apps Like Dave

Empower is a budgeting and financial management app that includes cash advance as part of its suite of features. Their transparent fee structure and user-friendly app design are notable strengths. However, Empower’s advance limit is lower than Dave’s, and they charge a monthly subscription fee.

Free Features

- Budgeting and financial management tools

Paid Features

- Cash advance

- Monthly subscription fee

- Transparent fee structure

- Lower advance limits compared to Dave

Why Empower?

- Over 1 million downloads on the Google Play Store.

- User Rating: 4.6 stars on the Google Play Store from 40,000+ reviews.

- Raised $20 million in Series A funding.

6. Chime SpotMe – Cash Loan Apps Like Dave

CHime is one of the most popular payday loan apps like Dave. This feature from the popular Chime bank allows eligible users to overdraft their accounts by a small amount without incurring fees. It’s a convenient option for Chime users, but the advance limit is typically lower than what Dave offers. Additionally, SpotMe is only available to existing Chime checking account holders.

Free Features

- Overdraft without fees for eligible users

- Direct deposit early access

Limitations

- Only available to existing Chime checking account holders

- Lower advance limits compared to Dave

Why Chime?

- Over 10 million downloads on the Google Play Store for the Chime app.

- User Rating: 4.7 stars on the Google Play Store from 620,000+ reviews.

- Chime has over 22.3 million customers as of 2024.

7. Varo Advance – Money Advance Apps Like Dave

Varo is a mobile banking app that includes cash advance as a feature. It boasts transparent fees, longer repayment terms compared to some competitors (like Dave), and the convenience of having a bank account integrated within the app. However, Varo requires users to open a Varo bank account to access cash advance.

Free Features

- Mobile banking app features

Paid Features

- Transparent fees for cash advance

- Longer repayment terms

- Requirement to open a Varo bank account to access cash advance

Why Varo?

- Over 5 million downloads on the Google Play Store.

- User Rating: 4.7 stars on the Google Play Store from 75,000+ reviews.

- Raised $482 million in total funding.

8. Cash App – Instant Money Apps Like Dave

Cash App, a popular money transfer app, also offers a feature called “Cash Boost.” This feature allows users to receive a portion of their direct deposit a day or two early for a small fee. Cash App doesn’t function exactly like Dave (it focuses on early access to direct deposits, not earned wages), but it can be a helpful option for those who receive regular direct deposits.

Free Features

- Money Transfer

- Cash Boost feature for discounts

Paid Features

- Early access to direct deposits for a small fee

- Investment and Bitcoin buying/selling

Why Cash App?

- Over 100 million downloads on the Google Play Store.

- User Rating: 4.2 stars on the Google Play Store from 2.13 million reviews.

- In the first quarter of 2024, 57 million users made monthly transactions with Cash App, generating an annual revenue of US$14.7 billion.

9. Branch – Cash Lending Apps Like Dave

Branch offers cash advance with a unique twist: they report your on-time repayments to credit bureaus, potentially helping you build your credit score. This is a valuable benefit that Dave does not offer. However, Branch’s advance limits might be lower than Dave’s for some users.

Free Features

- Cash advance

- Repayment reporting to credit bureaus

Paid Features

- Financial management tools

- Lower advance limits compared to Dave

Why Branch?

- Over 10 million downloads on the Google Play Store.

- User Rating: 4.5 stars on the Google Play Store from 20,000+ reviews.

10. Albert – Money Borrowing Apps Like Dave

Albert is a budgeting and financial management app that includes cash advance as a feature. They offer investment opportunities alongside cash advances, allowing users to grow their wealth while managing short-term cash flow potentially. While Albert’s advance limit might be lower than Dave’s, the investment features can be a significant advantage for some users.

Free Features

- Budgeting and financial management tools

Paid Features

- Cash advances

- Investment opportunities

- Financial advisor access

Why Albert?

- Over 5 million downloads on the Google Play Store.

- User Rating: 4.0 stars on the Google Play Store from 10,000+ reviews.

- Raised $100 million in total funding.

These stats provide a comprehensive overview of each app’s performance and user engagement in 2024, highlighting how they compare to apps like Dave.

Choosing the Right Cash Advance Apps Like Dave

Here’s a table summarizing the key features of the top ten cash advance apps like Dave we discussed:

| Feature |

Dave |

Earnin |

MoneyLion |

Brigit |

Klover |

Empower |

Chime SpotMe |

Varo Advance |

Cash App |

Branch |

Albert |

| Primary Function |

Cash Advance |

Cash Advance |

Cash Advance |

Cash Advance |

Cash Advance |

Cash Advance ( + Budgeting) |

Overdraft |

Cash Advance |

Early Direct Deposit |

Cash Advance |

Cash Advance ( + Budgeting, Investing) |

| Fees |

$1/month (optional tips) |

Tip-based |

Free & Premium |

Free & Premium |

Subscription Fee |

Subscription Fee |

None (for eligible users) |

Transparent Fees |

Small Fee |

Varies |

Subscription Fee |

| Advance Limit |

Up to $100/day, $750/pay period |

Up to $100/day, $750/pay period |

Up to $500 |

Up to $250 (Free), Up to $500 (Plus) |

Up to $200 |

Up to $250 |

Up to $200 |

Varies by user |

Up to $200 |

Varies by user |

Varies by user |

| Repayment |

Next Paycheck |

Next Paycheck |

Next Paycheck |

Next Paycheck |

Next Paycheck |

Next Paycheck |

Next Paycheck |

Varies |

1-30 days |

Varies |

Next Paycheck |

| Credit Building |

No |

No |

Can help build credit score |

Can help build credit score |

No |

No |

No |

No |

No |

Helps build credit score |

No |

| Additional Features |

Budgeting tools, Side hustle opportunities |

Overdraft protection, Financial wellness tools |

Investment accounts, Credit builder |

Budgeting tools, Credit builder |

Sweepstakes for increased limits |

Budgeting tools |

None |

Banking features |

None |

None |

Budgeting tools, Investing opportunities |

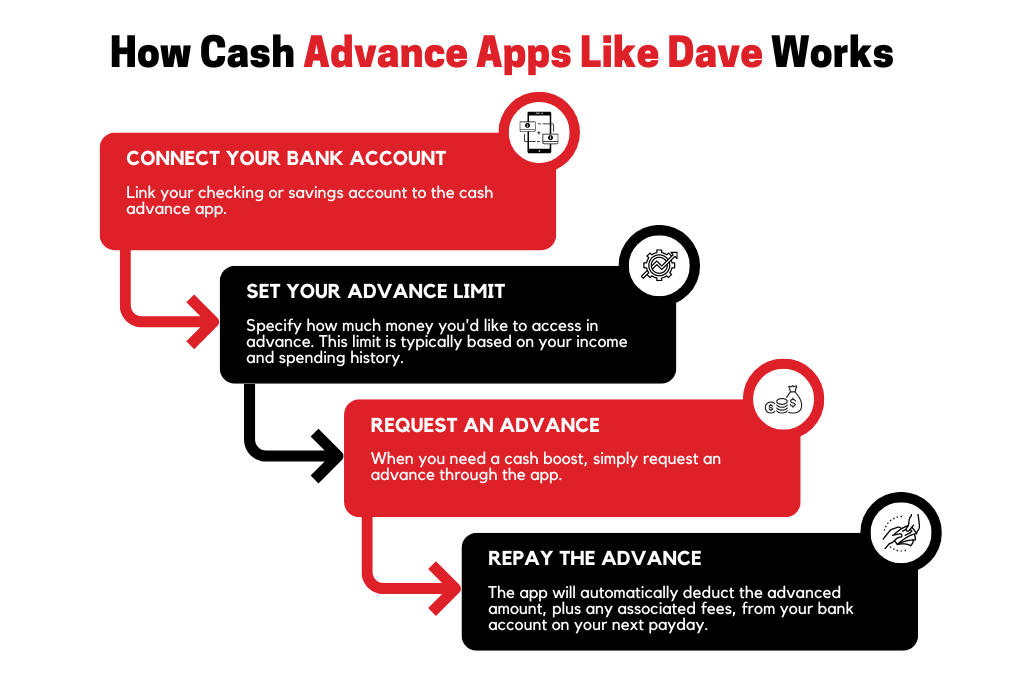

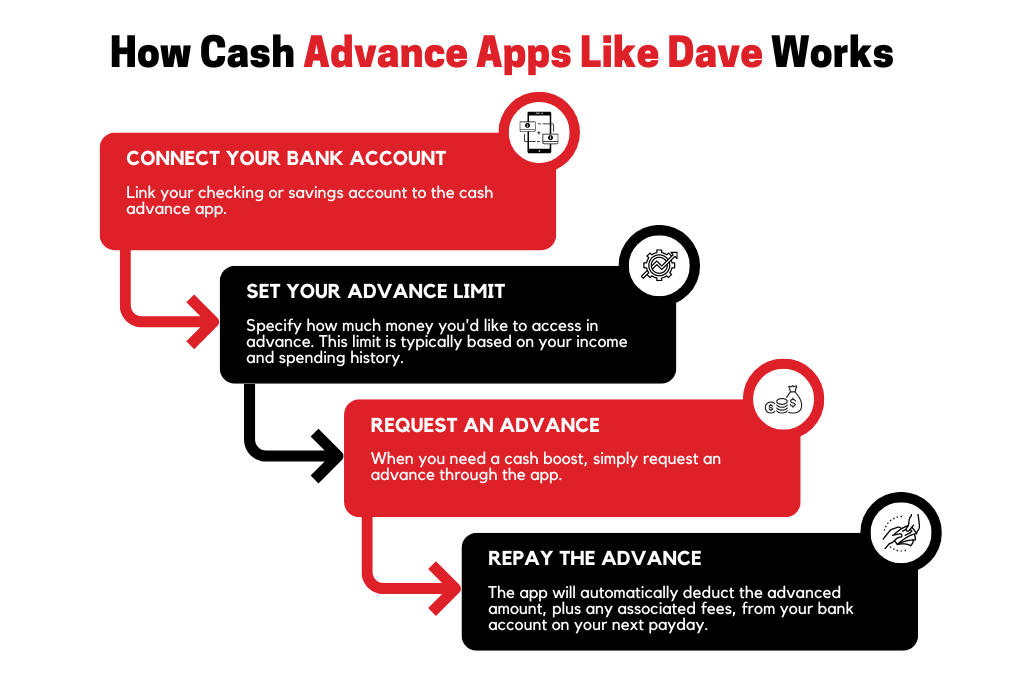

How Cash Advance Apps Like Dave Works

Cash advance apps (apps like Dave) are not traditional lenders. Instead, they function by providing access to a portion of your earned wages that hasn’t yet been deposited into your bank account. Here’s a simplified breakdown of the process:

- Connect Your Bank Account: Link your checking or savings account to the cash advance app.

- Set Your Advance Limit: Specify how much money you’d like to access in advance. This limit is typically based on your income and spending history.

- Request an Advance: When you need a cash boost, simply request an advance through the app.

- Repay the Advance: The app will automatically deduct the advanced amount, plus any associated fees, from your bank account on your next payday.

Important Considerations Before Using Cash Advance Apps Like Dave

While cash advance apps (like Dave) can be a lifesaver in a pinch, it’s crucial to use them responsibly. Here are some key factors to consider:

- Fees: Most apps charge fees for using their services. These can be a flat fee per advance, a subscription fee, or a percentage of the advanced amount.

- Limits: Each app has its own limit on how much you can advance. This limit is typically based on your income and spending history.

- Repayment Terms: The repayment period is usually until your next payday. Be sure you can comfortably afford the repayment on that date.

- Alternatives: Consider alternative solutions like budgeting apps, negotiating with bill providers, or selling unused items before relying on a cash advance app.

But before we get into the apps themselves, let’s understand how cash advance apps work and the key points to consider before using one.

Finding the Cash Advance App That’s Right for You

With so many cash advance apps (like Dave) available, choosing the right one depends on your individual needs and financial situation. Here are some factors to consider when making your decision:

- Cost: Compare fees and subscription costs to find the most affordable option for you.

- Advance Limit: Ensure the app offers an advance limit that meets your short-term cash needs.

- Repayment Terms: Consider how long you have to repay the advance to ensure it aligns with your budget.

- Features: Look for features that complement your financial goals, such as budgeting tools, credit building options, or investment opportunities.

- Eligibility: Make sure you meet the app’s eligibility requirements, such as minimum income or direct deposit requirements.

- Budgeting: Creating a realistic budget and tracking your expenses can help you avoid needing cash advances in the future. Several budgeting apps are available to assist you with this.

- Negotiate with Bill Providers: If you’re facing a short-term financial hardship, contact your bill providers and explain your situation. They may be willing to offer a payment extension or waive late fees.

- Sell Unused Items: Consider selling unwanted items online or through a local consignment shop to generate some quick cash.

- Side Hustle: Explore side hustle opportunities to increase your income and build a financial safety net.

Cash Advance Apps Like Dave Can Be a Helpful Tool, But Use Them Responsibly

Cash advance apps like Dave can be a valuable resource for managing short-term cash flow needs. However, it’s crucial to use them responsibly. Here are some key takeaways:

- Cash advance apps are not a substitute for long-term financial planning.

- Only borrow what you can comfortably repay by your next payday.

- Be aware of the fees associated with each app.

- Explore alternative solutions before relying on cash advances.

When used responsibly and strategically, cash advance apps can be a helpful tool for bridging temporary financial gaps and avoiding the high costs and predatory practices associated with traditional payday loans.

TechnBrains Can Build Your Cash Advance App Like Dave

Looking to create an app like Dave? Look no further than TechnBrains! We are a leading team of mobile app developers in New York, specializing in on-demand app services and boasting a portfolio brimming with innovative solutions.

Our team of experts can craft a secure, user-friendly cash advance app tailored to your specific needs and target audience. We’ll guide you through every step of the development process, ensuring your app adheres to all regulatory requirements and delivers a seamless user experience.

Don’t wait! Contact TechnBrains today for a free consultation and let’s turn your cash advance app vision into reality!

We hope this comprehensive guide empowers you to make informed decisions about cash advance apps like Dave and choose the option that best suits your needs. Remember, responsible financial management is key. By utilizing these tools strategically and focusing on long-term planning, you can achieve financial stability and peace of mind.