Managing finances effectively has become a daunting task for many. With rising costs and unexpected expenses, people often find themselves searching for solutions to budget better, track expenses, and access financial assistance instantly. Enter apps like Klover—a game-changer in the personal finance industry.

The demand for personal finance apps has skyrocketed. As of June 2024, there were 10,412 fintech firms operating in the U.S., reflecting a modest rise from the year before. Apps like Klover and Dave are now household names, offering instant cash advances, budgeting tools, and seamless account integration. However, building such an app comes with its own set of challenges. Questions like “What is the Klover app?” or “Does Klover work with Cash App?” dominate online searches, reflecting the curiosity and trust users have in such platforms.

If you’re considering developing a similar app, understanding the costs, features, and process is essential. Let’s explore what it takes to build a successful app like Klover in 2025.

What is the Klover App?

The Klover app is a leading cash advance platform offering users interest-free cash advances based on their earnings. Unlike traditional loans, it operates on a transparent model, requiring no credit checks. The app’s unique selling point lies in features like Klover App Boost, which provides additional financial perks through user engagement such as surveys and referrals.

How Does the Klover App Work?

Understanding how the Klover app works is key to grasping its popularity. Users connect their bank accounts to the app, which tracks income and spending patterns. This data enables Klover to offer cash advances up to a predetermined limit, ensuring users have funds when they need them.

One frequently asked question is, “Does Klover work with Cash App?” While the Klover cash app is designed to integrate seamlessly with various banking tools, compatibility with Cash App depends on account setup and user preferences.

Features of Apps Like Klover

Here are some features of klover money app:

- Instant Cash Advances: Apps like Klover and Dave provide users with immediate access to funds without the stress of waiting for payday.

- No Credit Checks: These platforms prioritize financial inclusivity, making them accessible to users with varying credit histories.

- Budgeting Tools: Many apps, including the Klover money app, offer insights into spending habits to promote better financial planning.

- User Rewards: Features like Klover App Boost incentivize engagement, offering benefits such as increased advance limits or additional perks.

Popular Cash Advance Apps Like Klover

Here are a few notable alternatives to apps like Klover:

- Dave

A pioneer in the cash advance space, Dave offers budgeting tools and advance limits of up to $500. Its seamless integration with financial accounts ensures a hassle-free user experience.

- Earnin

This app allows users to withdraw a portion of their earnings before payday. Its focus on fair usage and no-interest advances makes it a strong competitor to apps like Klover.

- Brigit

Designed for financial wellness, Brigit provides cash advances along with credit monitoring and savings tools, setting itself apart from other cash advance apps like Klover.

You can find the detailed listing of 10 Best Cash Advance Apps like Dave by clicking here!

Why Are Apps Like Klover So Popular?

The appeal of apps like Klover lies in their ability to address immediate financial needs without the red tape of traditional banking. The reason of their popularity mainly comes from open to users without stringent credit requirements. They have clear terms with no hidden fees. They offer flexibility options like Klover App Boost allow users to earn rewards and increase their benefits.

Now that we have an understating of apps like klover and how they work, lets get into build into Personal Finance Apps Like Klover

Key Features of Personal Finance Apps Like Klover

When it comes to managing money, apps like Klover have changed the game, making financial tools feel as accessible as checking your TikTok feed. In 2025, these apps are not just about balancing budgets—they’re about creating an experience that feels part financial guru, part BFF. Let’s dive into what makes them tick, with a sprinkle of examples, pop culture analogies, and future-forward features.

1. Enhanced User Authentication

Imagine the security of a Wakandan vault (yes, the one from Black Panther) protecting your finances. Apps like Klover now use multi-factor authentication to ensure only you can access your account. By 2025, expect behavioral biometrics, where apps recognize you by how you type or swipe.

Remember when Joey from Friends bought that giant ceramic dog? If he had an app like Klover, an AI-driven budgeting tool might have whispered, “Hey, maybe not.” These tools categorize expenses automatically, set limits, and even suggest ways to save. For example, if you’re spending too much on coffee, your app could suggest brewing at home, gamifying the process by showing how much you’ve saved by the end of the month.

3. Cash Advance Services

When you’re short on cash before payday, cash advance apps like Klover come to the rescue. Think of it as the Spider-Man of personal finance—stepping in when things get sticky. Features like Klover App Boost let users access small advances in exchange for simple tasks like completing surveys. By 2025, expect advances to be dynamic, increasing based on your spending habits or timely repayments.

4. Seamless Integration

Ever tried fitting a square peg in a round hole? That’s what outdated apps feel like when they don’t integrate well. Apps like Klover excel at compatibility, syncing effortlessly with tools like Cash App or your traditional bank. Addressing the query “Does Klover work with Cash App?”—yes, and likely much more in 2025, including crypto wallets and even international payment platforms. Think of it as your financial Avengers assembling all your accounts into one manageable dashboard.

5. Rewards and Gamification

Who says managing money has to be boring? In the style of video games, apps like Klover have introduced gamified rewards systems. Complete a savings challenge, and you might unlock discounts or badges. By 2025, you might even see leaderboards where you can compete with friends for “Top Saver” status.

6. Advanced Analytics and Reports

Finance apps aren’t just about showing numbers—they’re about telling stories. Modern apps like Klover use AI to create tailored reports showing where your money is going and how to improve. By 2025, these could include spending heatmaps (think Google Maps but for your wallet) and voice-activated AI assistants, like a financially savvy Alexa.

7. Real-Time Spending Insights

Did you really need to buy those limited-edition sneakers at 2 AM? Apps like Klover provide real-time spending insights, offering gentle nudges to stay on track. Future versions might flag unusual activity—say, a spike in spending on streaming services—and suggest alternatives.

8. Integrated Savings Goals

Saving for that dream vacation? Apps like Klover help you set and monitor goals, even automating savings from each paycheck. In 2025, these tools may offer features like:

- Savings streaks: Rewarding you for consistent contributions.

- Goal visualization tools: Showing your tropical getaway in AR to keep you motivated.

9. Broader Compatibility with Financial Platforms

By 2025, apps like Klover might integrate with platforms beyond Cash App, answering questions like “Does Klover work with Cash App?” with expanded compatibility. From crypto wallets to AI-powered investment tools, the goal is to unify all your financial data in one place.

With features that combine security, innovation, and fun, apps like Klover are redefining how we handle money. Whether it’s the Klover money app helping you avoid fees or answering the all-important “How does Klover app work?”, these tools ensure financial management feels less like a chore and more like a superpower.

By 2025, you might even joke that managing your money is easier than managing your Netflix queue. But the real magic lies in how these apps make saving, spending, and planning feel as effortless as scrolling Instagram. Financial freedom? Now that’s a trend worth following.

Development Costs for Apps Like Klover: A Detailed Breakdown

Creating apps like Klover involves careful planning, skilled execution, and substantial financial investment. The total cost depends on various elements, including features, team expertise, platform support, and monetization strategies. Here’s what influences the cost of developing a personal finance app like Klover.

1. Features and Complexity

The scope of features plays a significant role in determining development costs.

Basic Apps

Apps with essential features such as user registration, basic dashboards, and simple integrations typically cost $35,000–$80,000. These are ideal for startups or MVPs aiming to test the market.

Advanced Apps

More complex apps, like Klover or similar platforms, which include AI-powered tools, gamification features, and budget tracking capabilities, can cost anywhere from $85,000–$200,000 or more. Additional features like real-time notifications, data analytics, and integrations with banking APIs further add to the cost.

2. Development Team

A skilled and experienced team is important for building apps like Klover successfully. That is why TechnBrains as a reputed finance app development company gets hired. We help you streamline the process, as they offer end-to-end services, including planning, development, and post-launch support. Our team typically consists of:

- Mobile Developers: Professionals skilled in iOS and Android development, charging between $40–$100/hour depending on their experience and location.

- UI/UX Designers: Focused on crafting intuitive and visually appealing interfaces to enhance user experience.

- Backend Engineers: Responsible for building robust server-side functionality, enabling secure data handling and seamless app performance.

- Quality Assurance (QA) Testers: Ensure the app functions flawlessly across devices and scenarios.

3. Platform Support

Developing apps like Klover for multiple platforms, such as iOS and Android, increases development costs but maximizes user reach. For apps like Klover and Dave, cross-platform development using tools like Flutter or React Native can reduce costs while ensuring consistency across platforms. Each platform has unique technical requirements, which demand specialized development resources.

- iOS App Development: Often more straightforward due to fewer device variations, but it requires adhering to Apple’s strict guidelines.

- Android App Development: Involves addressing a broader range of device specifications, making development and testing more time-intensive.

4. Monetization Features

Monetization strategies are integral to the business model of apps like Klover and significantly impact development costs. App Monetization Strategies help ensure long-term revenue streams while elevating user engagement. You can offer subscriptions. Offering premium memberships with added benefits requires additional backend support and payment gateway integration. Also go for advertisements, by incorporating ad networks increases complexity, as it involves real-time data handling and analytics.

- Premium Tiers: Allowing users to unlock advanced features enhances app appeal but requires more intricate coding and design efforts.

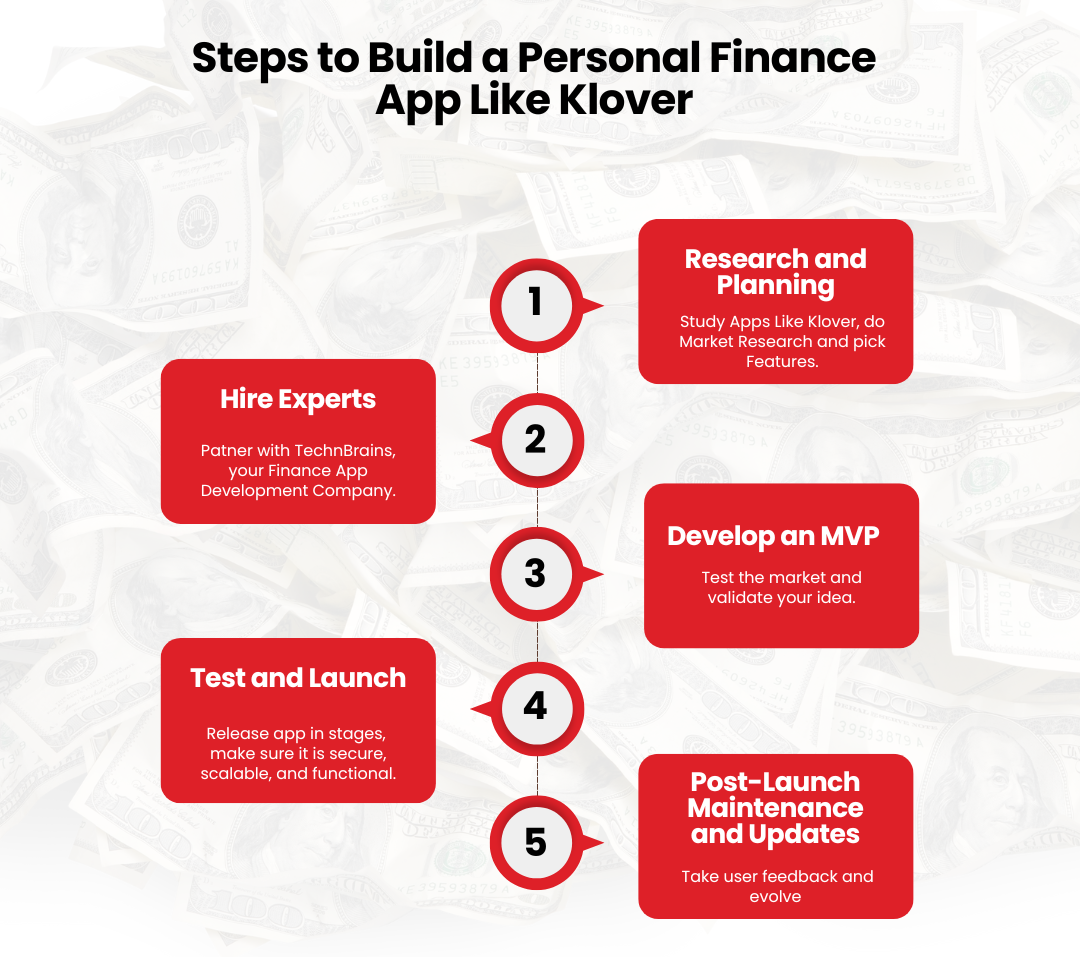

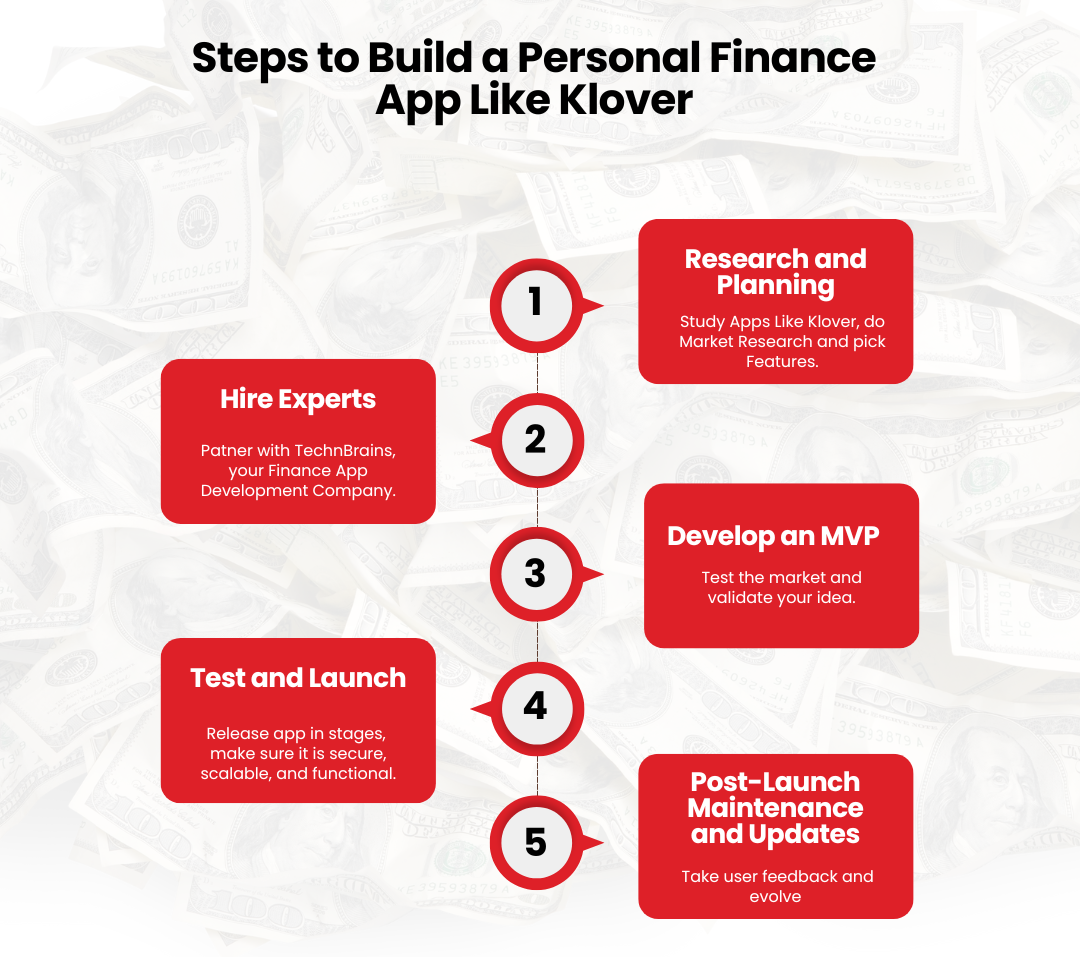

Steps to Build a Personal Finance App Like Klover

Building a personal finance app like Klover involves several important steps, from planning and research to hiring the right development team and launching the app. Each phase requires careful attention to detail and strategic decision-making to ensure that the final product meets user expectations and provides a seamless experience. Let’s dive into the essential steps involved in developing an app like Klover.

1. Research and Planning

Before getting on the development of an app like Klover, it’s crucial to thoroughly research and plan. This step includes:

Studying Apps Like Klover

To build an app that competes in the crowded personal finance app market, it’s essential to analyze successful apps like Klover. Identify their features, functionalities, and user experiences that make them popular. Apps like Klover excel due to their easy cash advances, budgeting tools, and user-friendly interfaces, so it’s essential to identify which features resonate with users.

Market Research

Understanding the target audience and analyzing competitors helps in defining the app’s unique value proposition. Look at both direct competitors (like the Klover app and other similar finance apps) and indirect ones to find gaps and opportunities.

Feature Prioritization

Decide on the core features for your app. Start by listing essential features like budgeting, cash advances, and financial insights. This will help focus the development on what’s most important to users.

2. Hire Experts

Building a high-quality personal finance app like Klover requires a skilled team of professionals. Here’s how to proceed:

Finance App Development Company

Hiring a reputable finance app development company is crucial. A top-notch development company can offer comprehensive services, including app design, development, and post-launch support. They can help ensure the app is secure, scalable, and ready for market launch.

Choosing the Right Team

Besides developers, you’ll need experts in UI/UX design, security, and testing. A strong team is necessary to ensure the app is functional and offers a seamless user experience. For example, if you are aiming for an app like Klover, you’ll need developers who specialize in finance, as they’ll understand how to integrate critical features like cash advances and budgeting tools.

Outsourcing vs. In-House Development

Consider whether you want to outsource the development or build an in-house team. Outsourcing allows you to tap into global talent, but in-house teams can offer greater control over the project.

Hiring the right professionals is critical to building a secure, scalable, and user-friendly app like Klover.

3. Develop an MVP (Minimum Viable Product)

Once your team is in place, the next step is to get started on MVP App Development. The MVP is a version of the app with just the essential features, allowing you to launch early and gather feedback for improvement. For an app like Klover, focus on the core features that are most valuable to users, such as:

- Cash Advances: Provide users with the ability to access cash advances quickly.

- Budgeting Tools: Help users track and manage their expenses.

- Security: Incorporate strong encryption and multi-factor authentication to protect sensitive financial data.

- User Registration and Profiles: A simple onboarding process allows users to sign up and start using the app quickly.

Use agile development methodologies to iterate and improve upon the MVP. This allows you to adapt quickly based on user feedback and market demands. Building an MVP for an app like Klover allows you to test the market and validate your ideas without spending significant resources on unnecessary features.

4. Test and Launch

Rigorous testing is necessary to make sure the app is free of bugs, crashes, or security flaws. This includes testing functionality, performance, and user experience. Conduct beta testing with real users to gather feedback on usability, design, and functionality. This step can uncover hidden issues and provide insights on how the app can be improved.

After finalizing the app and ensuring all features are working perfectly, it’s time to launch. Consider releasing the app in stages, starting with a smaller group of users before making it available to the public. This phased approach helps in managing any issues that arise during the initial launch phase. Launching an app like Klover requires careful testing to ensure that the product is secure, scalable, and functional.

5. Post-Launch Maintenance and Updates

After the app is launched, it’s important to keep the momentum going. Continuous updates and maintenance are key to ensuring the app remains relevant and functional. Regularly fix bugs and issues reported by users to maintain a smooth experience. Based on user feedback and evolving market demands, continue to add features and improve existing ones. As the number of users grows, it’s crucial to optimize the app’s performance and ensure it can handle increased traffic and data loads. Regularly update the app’s security features to protect user data and stay compliant with the latest regulations.

Why Invest in Apps Like Klover in 2025?

The financial app market is booming. Cash advance apps like Klover and Dave address a growing demand for financial solutions that are quick, user-friendly, and transparent. They provide:

- Ease of Access: No credit checks or lengthy approval processes.

- Customer Loyalty: Features like Klover App Boost encourage user engagement and retention.

- Market Growth Potential: With the personal finance app market expected to grow significantly by 2025, apps like Klover offer a lucrative opportunity for developers and businesses.

By partnering with an experienced finance app development company, businesses can ensure a smooth development process and a high-quality product that meets user expectations.

Let’s Build Your App Like Klover

Developing apps like Klover might require a substantial initial investment, but with thoughtful planning and effective execution, the long-term benefits make it a worthwhile venture. At TechnBrains, we pride ourselves on delivering top-notch mobile app development services in Dallas. Our team is dedicated to creating innovative applications like Klover that not only meet but surpass user expectations.

With a roster of certified FinTech app developers, we leverage their expertise to design cutting-edge solutions tailored to your specific needs. From conceptualization to launch, we are committed to excellence at every step. Don’t miss the opportunity to bring your vision to life—partner with us to develop the next game-changing app!