Have you ever wondered how FinTech app developments like PayPal, Robinhood, and Stripe have become essential in our daily lives? They solved a problem we didn’t even know we had, and they did it seamlessly.

FinTech apps, short for financial technology applications, have revolutionized how we handle money. Whether it’s making payments, investing, or managing insurance, these mobile apps have brought financial services right to our fingertips.

The FinTech industry has seen explosive growth, and it’s not slowing down anytime soon. According to a report by Statista, The global market for Digital Assets in the FinTech industry is expected to expand by 5.13% between 2024 and 2028, leading to a market size of US$3409.00 billion by 2028.

This growth presents an incredible opportunity for entrepreneurs and businesses looking to venture into FinTech app development.

This blog post aims to provide a practical guide on how to build a FinTech app in 2024. We’ll cover everything from understanding what FinTech apps are, the development process, the cost to develop a FinTech app, and even tips on launching and growing your app.

So, whether you’re an aspiring entrepreneur or a business looking to expand into the FinTech space, this guide is for you.

What Are FinTech Apps?

FinTech apps are software applications designed to facilitate financial services through digital means. They can range from simple payment apps to complex financial management systems. FinTech apps are reshaping how we interact with money, offering users convenience, speed, and efficiency.

What is FinTech app development?

FinTech app development involves creating software applications for financial services, such as banking, investment, or payment solutions. These apps use technology to enhance financial transactions, improve user experiences, and provide innovative solutions for managing money and investments efficiently.

How Do Fintech Apps Work?

Ever wondered how a simple tap on your phone can move money across the world in seconds? Fintech apps have streamlined financial transactions to the point where they feel almost magical. But behind that magic lies a complex network of processes, technology, and innovation.

Fintech apps combine various financial services into one easy-to-use platform, allowing you to manage your money, invest, pay bills, or even lend and borrow—all from the comfort of your smartphone.

1. User Authentication

It all starts with security. Before you can access the app, you’ll need to log in. This is where FinTech apps shine by using advanced authentication methods like:

- Biometric Scanning: Fingerprints or facial recognition—just like how Tony Stark accesses his Iron Man suit.

- Two-Factor Authentication (2FA): A code sent to your phone or email to confirm it’s really you.

Why? Because your finances are as precious as the One Ring, and you don’t want them falling into the wrong hands.

2. Data Encryption

Once you’re in, every piece of information you enter is encrypted.

Encryption turns your data into a secret code that only your app and the bank can understand. It is like sending a letter in a secure envelope that only the recipient can open.

Example: When you make a payment, your card details are encrypted so that hackers see gibberish instead of your actual information. Pretty cool, huh?

3. APIs (Application Programming Interfaces)

Fintech apps use APIs to communicate with banks, financial institutions, and even other FinTech services. These APIs are the behind-the-scenes tech that allows your app to:

- Check Your Bank Balance: No need to visit your bank; just a tap, and voila!

- Make Payments: Send money to your friend, even if they’re halfway across the world.

- Invest in Stocks: Buy a share of your favorite company without leaving your couch.

Example: Think of APIs as the cables that connect your gaming console to the TV. Without them, you’d just be staring at a blank screen.

4. Transaction Processing

When you hit “Send Money” or “Invest,” that’s when the real action happens.

The app processes your request in real-time, contacting the necessary banks, exchanges, or payment processors to move your money. It’s like watching a Rube Goldberg machine where everything falls into place perfectly, only much faster!

5. User Experience (UX)

Fintech apps make the complex look simple. How? By offering a smooth, user-friendly experience. It’s like having Alfred from Batman guide you through your finances—always there, always helpful.

- Intuitive Design: Everything is where you expect it to be.

- Real-Time Updates: See your account balance update as soon as you spend.

- Push Notifications: Stay on top of your finances with timely alerts.

If only managing finances in real life were as easy as playing Monopoly—but without the risk of flipping the board in frustration!

6. Continuous Improvement

Fintech apps are constantly evolving. With new features, improved security, and enhanced user experiences, they’re always ahead of the curve.

It’s like how your favorite superhero gets a new gadget every time a new movie comes out—only this time, it’s your finances that are getting the upgrade.

Fintech apps work by securely managing your data, processing transactions in real-time, and providing you with an easy-to-use interface. Whether you’re paying a friend back for lunch or investing in the stock market, fintech apps make it feel effortless.

Remember: The next time you send money or check your balance with just a few taps, you’re using cutting-edge technology that’s making your financial life easier—one swipe at a time.

What is FinTech App Development Company?

A FinTech app development company specializes in creating software applications for the financial technology sector. These companies design, develop, and maintain apps that enable digital banking, payments, investing, insurance, and other financial services. TechnBrains provides tailored solutions to meet the unique needs of businesses in the FinTech industry, ensuring secure and user-friendly experiences.

Popular FinTech App Development

Here’s a list of popular FinTech apps:

- PayPal – Global leader in online payments and money transfers.

- Venmo – Social payment app for splitting bills and sending money to friends.

- Robinhood – Commission-free stock trading platform for individual investors.

- Square – Payment processing and financial services for small businesses.

- Mint – Personal finance management app for budgeting and expense tracking.

- Chime – Mobile banking app offering fee-free banking services.

- Coinbase – Cryptocurrency exchange platform for buying and selling digital currencies.

- SoFi – Comprehensive financial platform offering loans, investing, and banking.

- Zelle – Fast, free, and secure money transfer app linked to your bank account.

- Acorns – Micro-investing app that rounds up purchases and invests the spare change.

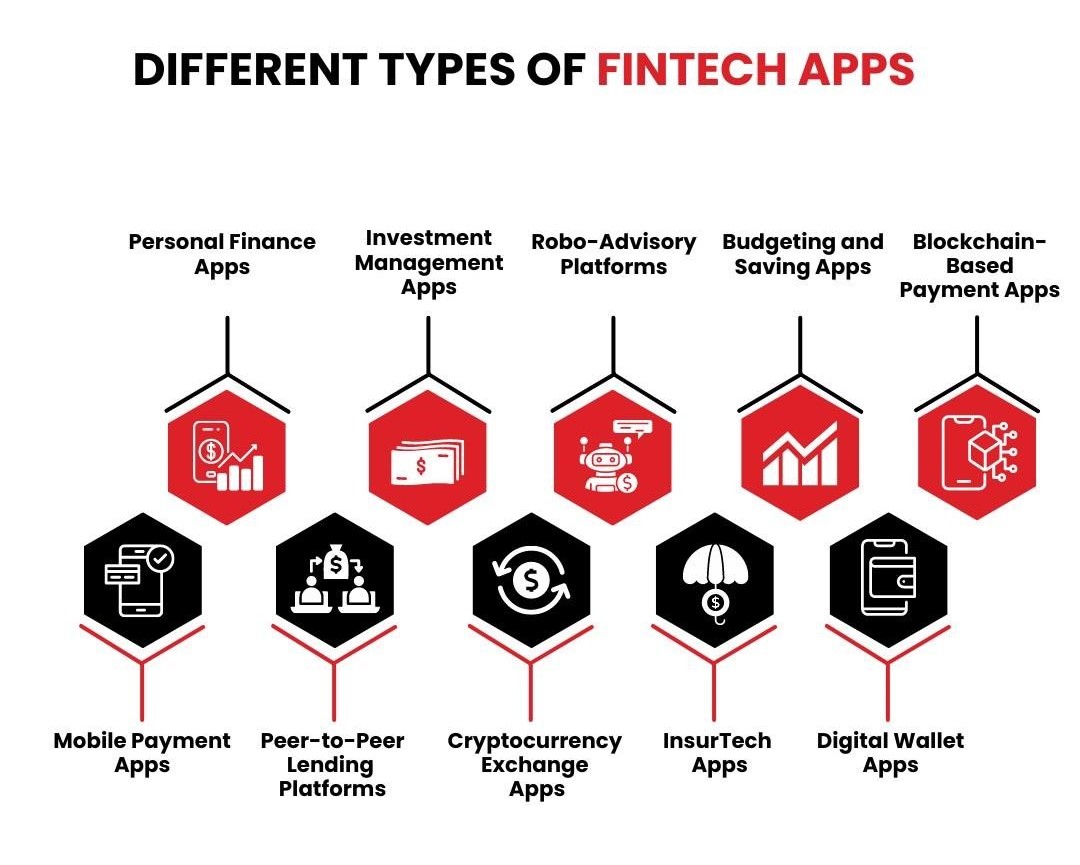

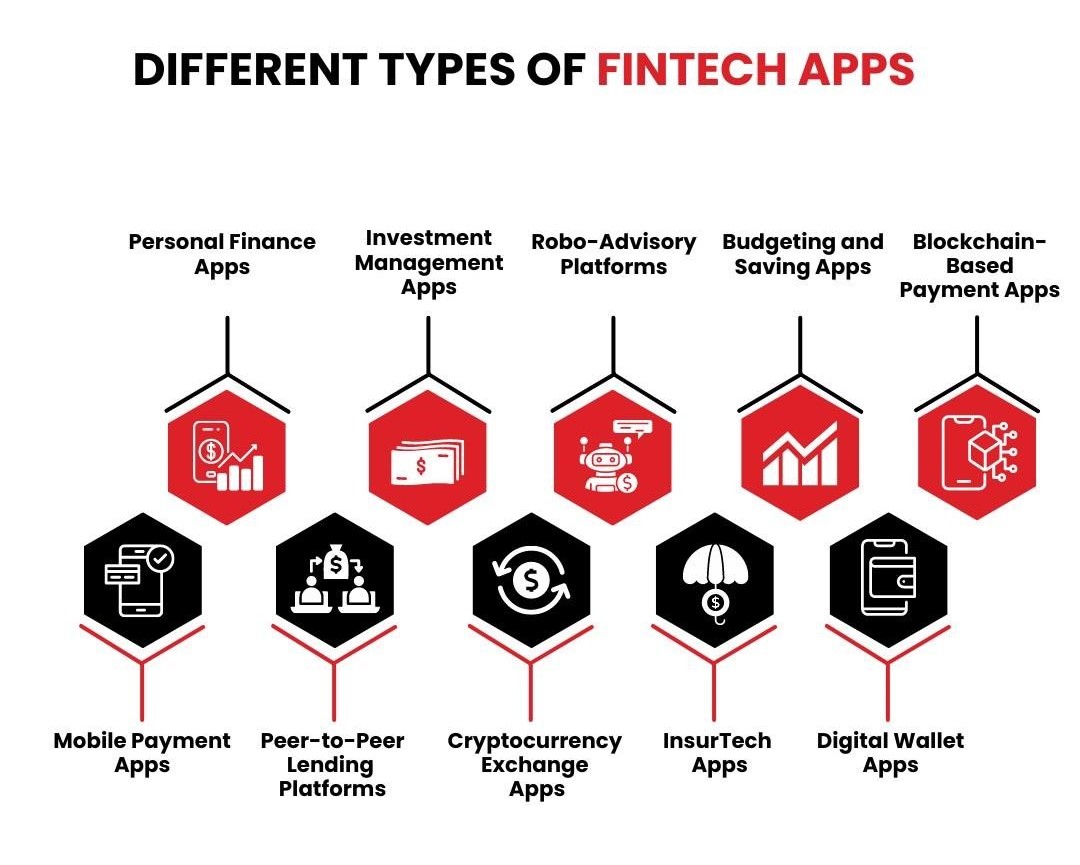

Different Types of FinTech Apps

These apps cater to different financial needs, making them versatile tools for users and businesses alike. Here’s a look at some common types:

1. Mobile Payment Apps

These apps have revolutionized the way we transact. They enable peer-to-peer payments, online shopping, and even in-store purchases through mobile devices. Fintech app development in this space focuses on creating secure, user-friendly platforms that integrate seamlessly with various payment systems.

2. Personal Finance Apps

Empowering individuals to manage their finances effectively, personal finance apps offer budgeting, spending tracking, investment management, and bill payment features. Fintech app developers in this domain prioritize data security, intuitive user interfaces, and robust financial algorithms.

3. Peer-to-Peer Lending Platforms

These apps connect borrowers and lenders directly, bypassing traditional financial institutions. Fintech app development for peer-to-peer lending involves creating platforms that facilitate secure transactions, credit assessments, and loan servicing.

4. Investment Management Apps

Democratizing investing, these apps provide access to stocks, bonds, ETFs, and other investment options. Fintech app development in this area requires a deep understanding of financial markets, risk management, and user experience design.

5. Cryptocurrency Exchange Apps

Catering to the growing cryptocurrency market, these apps enable users to buy, sell, and trade digital currencies. Fintech app development for cryptocurrency exchanges necessitates robust security measures, compliance with regulatory frameworks, and integration with various blockchain networks.

6. Robo-Advisory Platforms

Leveraging algorithms, these apps offer automated financial advice and investment management services. Fintech app development in this space involves developing sophisticated algorithms, user-friendly interfaces, and risk assessment models.

7. InsurTech Apps

Transforming the insurance industry, InsurTech apps offer digital-first insurance policies, claims processing, and customer support. Fintech app development in this sector requires expertise in insurance regulations, data analytics, and user experience design.

8. Budgeting and Saving Apps

Helping users achieve their financial goals, these apps offer budgeting tools, savings challenges, and investment options. Fintech app development in this area focuses on gamification, behavioral finance, and user engagement.

9. Digital Wallet Apps

Storing payment information securely, digital wallet apps enable contactless payments and digital receipts. Fintech app development for digital wallets emphasizes security, convenience, and integration with various payment systems.

10. Blockchain-Based Payment Apps

Leveraging blockchain technology, these apps offer secure, transparent, and decentralized payment solutions. Fintech app development in this space requires expertise in blockchain programming, cryptography, and regulatory compliance.

Your FinTech app vision deserves a world-class team. TechnBrains is ready to be your partner in innovation. Book your free consultation now!

Benefits of FinTech Apps For Users: Convenience, Lower Costs, and Better Access to Financial Services

Let’s face it—nobody likes standing in line at the bank, right? FinTech apps have completely transformed how we handle our finances by bringing the bank to our fingertips. But convenience is just the tip of the iceberg.

- Convenience: FinTech app development allow users to manage their finances 24/7, breaking the traditional 9-to-5 banking barrier. Whether you’re catching a flight, relaxing at home, or even stuck in traffic (not recommended!), your financial world is just a tap away.

- Lower Costs: This means lower transaction fees, better exchange rates, and even zero-cost services in some cases. Who doesn’t love saving a little extra cash?

- Better Access to Financial Services: These apps are making financial services accessible to everyone, including those who were previously underserved or excluded by traditional banks. From microloans to digital wallets, FinTech apps are breaking down barriers, making it easier for people to access the financial tools they need—no matter where they are in the world.

Benefits of FinTech Apps For Businesses: Streamlined Operations, Increased Customer Engagement, and Data-Driven Insights

But what’s in it for businesses? A lot, actually. FinTech apps are not just a win for users; they’re a game-changer for companies, too.

- Streamlined Operations: Imagine automating tedious financial processes—billing, payroll, inventory management, you name it. FinTech app development can do that, allowing businesses to focus on what they do best: growing their brand. By integrating FinTech solutions, businesses can reduce manual errors, speed up transactions, and even manage multiple financial operations from a single platform. The result? Time saved and efficiency gained, which directly translates into cost savings.

- Increased Customer Engagement: Who doesn’t want happy, engaged customers? FinTech mobile apps offer personalized experiences that keep users coming back for more. With features like push notifications, personalized financial advice, and real-time updates, businesses can engage with their customers in a more meaningful way. This increased engagement not only boosts customer satisfaction but also drives loyalty—ensuring that your customers stick around for the long haul.

- Data-Driven Insights: FinTech mobile app development provides businesses with valuable insights into customer behavior, spending patterns, and preferences. This data can be a goldmine, allowing companies to tailor their offerings, improve their services, and make informed decisions that drive growth. In essence, FinTech apps help businesses turn data into actionable insights—giving them a competitive edge in the market.

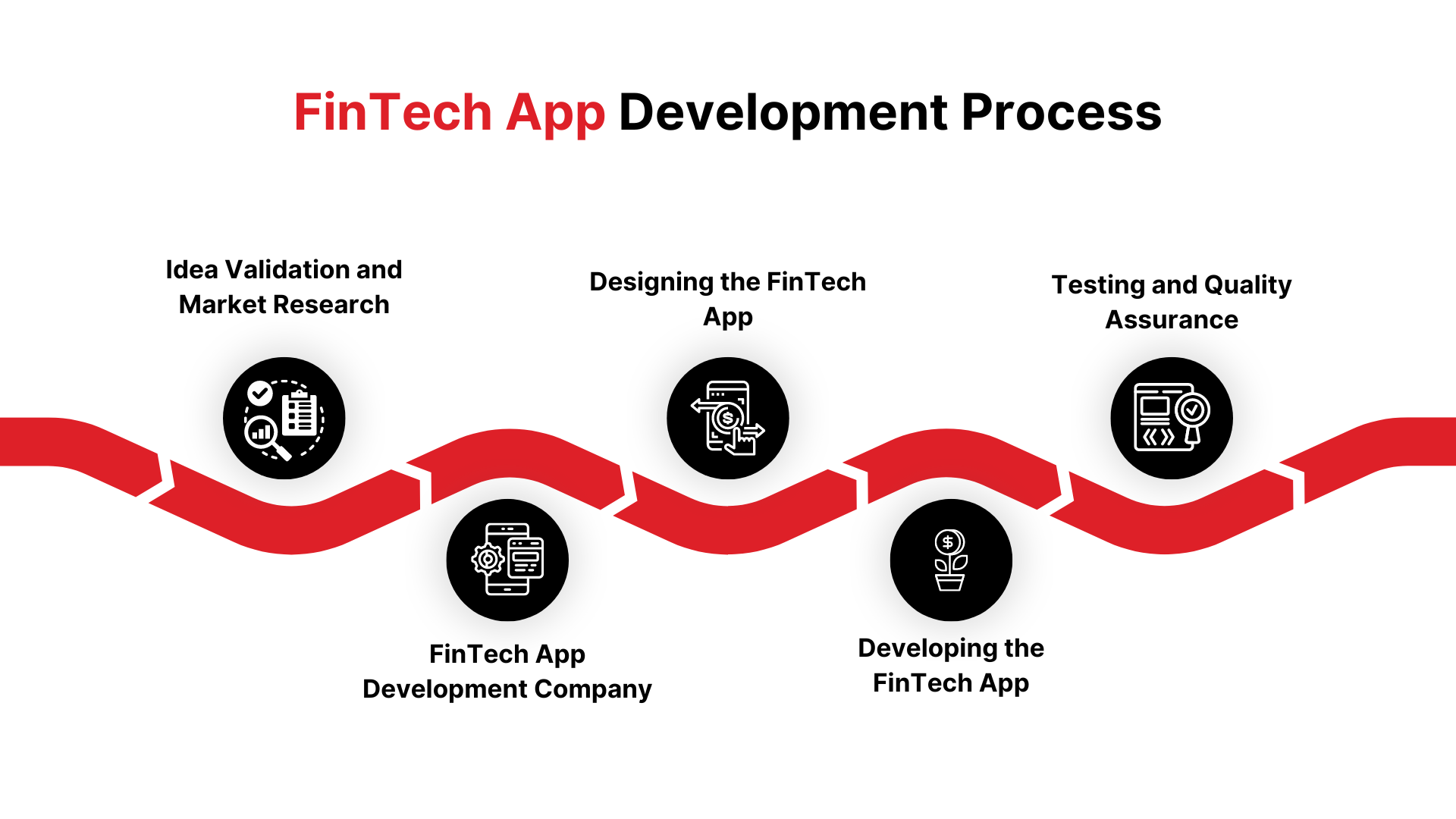

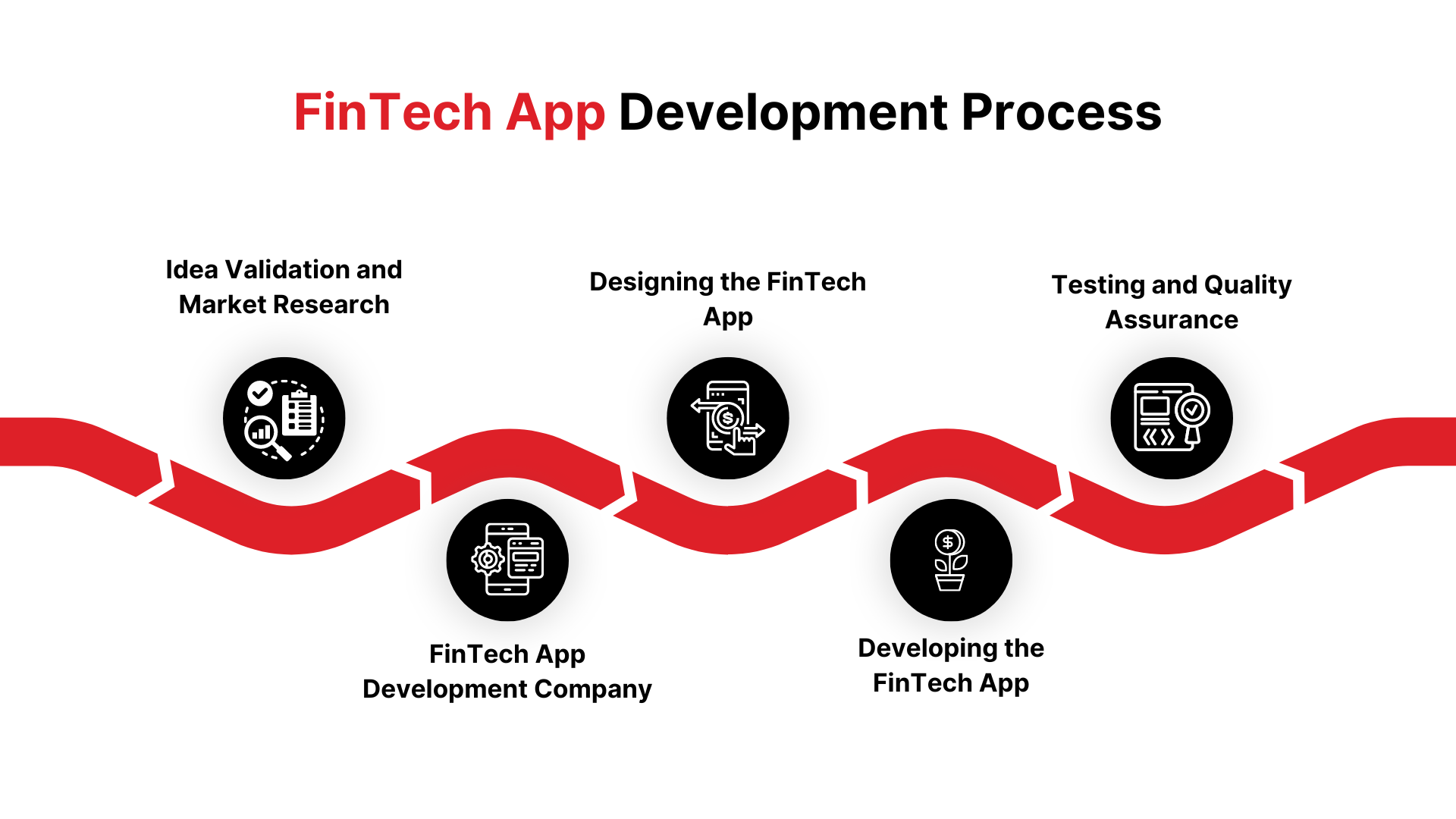

FinTech App Development Process

Here is how we master FinTech app development, and you can too.

1. Idea Validation and Market Research

Before diving into FinTech app development, it’s crucial to validate your idea. Identify a niche that isn’t oversaturated and has a clear problem that your app can solve. Conduct market research to understand your target audience’s needs, pain points, and preferences. This research will guide your development process and help you build a FinTech app that resonates with users.

2. FinTech App Development Company or In-house Team?

Now that your idea is validated, you need to decide whether to hire a FinTech app development company or build an in-house team. Both options have pros and cons:

- In-house Team: Offers more control and easier communication but can be expensive and time-consuming.

- Development Company: TechnBrains Brings expertise and a quicker turnaround.

When choosing a development partner, consider factors like expertise, portfolio, and client testimonials. TechnBrains, for instance, is a top FinTech app development company that has helped businesses turn their ideas into successful FinTech apps. With a team of experts, we offer tailored solutions that meet your business needs.

3. Designing the FinTech App

Design is where your FinTech app starts to take shape. A user-centric approach is key:

- User Experience (UX) Design: Focuses on the app’s usability and ensuring it meets user needs.

- User Interface (UI) Design: Involves creating an attractive and intuitive interface.

A well-designed FinTech app should be easy to navigate, visually appealing, and responsive across all devices. Remember, first impressions matter—especially in FinTech.

4. Developing the FinTech App

Here’s where the magic happens:

- Technology Stack: Choose the right programming languages, frameworks, and tools. Popular choices include React Native for cross-platform development and Python for backend services.

- Development Methodologies: Agile app development and Waterfall are the most common. Agile allows for iterative development, making it easier to adapt to changes, while the waterfall is more linear and structured.

- Security and Compliance: Implement encryption, multi-factor authentication, and regular security audits. Compliance with regulations like GDPR and PCI DSS is also essential.

5. Testing and Quality Assurance

Don’t underestimate the importance of rigorous testing. Different types of testing ensure your app is bug-free and user-friendly:

- Unit Testing: Tests individual components.

- Integration Testing: Ensures different components work well together.

- User Acceptance Testing (UAT): Validates that the app meets user expectations.

Cost to Develop a FinTech App

If you want a custom FinTech app for safe online transactions, building a fintech app could start at around $40,000 and take three to four months to develop. On the other hand, a simple banking app might cost you between $20,000 and $40,000. For a FinTech app with the latest tech and advanced features, the price could be in the range of $50,000 to $90,000. If you’re thinking of a highly complex financial app, be prepared to spend up to $200,000 or more.

Additionally, The cost to develop a FinTech app can vary widely based on several factors:

- App Complexity: A simple payment app will cost less than a complex investment platform.

- Features: More features mean higher costs.

- Platform: Developing for iOS, Android, and web will increase costs.

- Development Team Location: Teams in North America tend to have higher hourly rates compared to teams in Eastern Europe or Asia.

Cost Breakdown

- Development: Typically the most significant portion of the budget.

- Design: Good design is crucial, but it can also add to the costs.

- Testing: Ensuring quality can’t be skipped, but it comes at a cost.

- Marketing: Getting your app in front of users requires investment.

To give you a clearer picture, here’s a breakdown of estimated costs and timeframes for different types of FinTech apps:

| FinTech App Type |

Cost Range |

Timeframe |

Development Complexity |

Target Audience |

Key Features |

| Mobile Payment App |

$45,000 – $85,000 |

3 – 5 months |

Medium |

General Consumers, Retailers |

Secure Transactions, QR Code Scanning |

| Personal Finance App |

$55,000 – $105,000 |

4 – 6 months |

Medium |

Individual Users |

Budget Tracking, Expense Management |

| Peer-to-Peer Lending Platform |

$65,000 – $125,000 |

5 – 7 months |

High |

Small Businesses, Individuals |

Loan Matching, Credit Scoring |

| Investment Management App |

$75,000 – $160,000 |

6 – 8 months |

High |

Investors, Financial Advisors |

Portfolio Management, Real-Time Data |

| Cryptocurrency Exchange App |

$85,000 – $210,000 |

7 – 9 months |

Very High |

Crypto Enthusiasts, Traders |

Multi-Currency Support, Real-Time Trading |

| Robo-Advisory Platform |

$95,000 – $190,000 |

8 – 10 months |

Very High |

Investors, Wealth Management Firms |

Automated Investment Advice, AI Analytics |

| InsurTech App |

$110,000 – $260,000 |

9 – 12 months |

Very High |

Insurance Companies, Policyholders |

Policy Management, Claim Processing |

| Budgeting and Saving App |

$45,000 – $85,000 |

3 – 5 months |

Medium |

Individuals, Families |

Goal Setting, Automated Savings |

| Digital Wallet App |

$55,000 – $105,000 |

4 – 6 months |

Medium |

General Consumers, Businesses |

Payment Integration, Loyalty Programs |

| Blockchain-Based Payment App |

$75,000 – $160,000 |

6 – 8 months |

Very High |

Tech-Savvy Users, Financial Institutions |

Decentralized Transactions, High Security |

These estimates can help you plan your budget and timeline effectively.

FinTech app developers at TechnBrains build innovative, secure, and scalable financial solutions. Let’s bring your project to life—contact us today to get started!

Launching and Growing Your FinTech App

You’ve put in the work and spent countless hours refining every feature, and now your FinTech app is ready to go live. But how do you ensure a successful launch? And once your app is out there, how do you keep growing? Let’s break it down with a focus on effective fintech app development strategies.

Launch Strategies

The launch of your FinTech app is like the opening night of a blockbuster movie. You want to make sure everything goes smoothly so that the audience (your users) leaves with rave reviews. Here’s how to nail it.

Ever heard the phrase, “Don’t put all your eggs in one basket”? The same goes for launching your FinTech app. Instead of going all out on day one, consider a soft launch. This means releasing your app to a small, targeted audience—think beta testers or a select group of users.

Why it works: A soft launch allows you to gather valuable feedback and identify any glitches or issues that might have slipped through the cracks during the fintech app development process. Think of it as a dress rehearsal. Once you’ve ironed out the kinks, you’ll be ready for the big debut.

Marketing Campaign

Now, it’s time to introduce your amazing app to the world. A well-planned marketing campaign is key to generating buzz and attracting users.

- Social Media: Use platforms like Instagram, Twitter, and LinkedIn to spread the word. Share sneak peeks, behind-the-scenes content, and user testimonials. And don’t forget those catchy hashtags!

- PR: Reach out to industry blogs, tech websites, and financial news outlets. A feature in a popular publication can greatly improve your app’s visibility.

- Influencer Partnerships: Collaborate with influencers who align with your brand. For example, if your app focuses on personal finance, partner with financial bloggers or YouTubers. Their endorsement can drive significant traffic to your app, making your fintech app development efforts pay off.

App Store Optimization (ASO)

Imagine your app is a needle in the app store haystack. App Store Optimization (ASO) is the magnet that helps users find it.

- Keywords: Research and include relevant keywords in your app’s title and description. This boosts your app’s chances of appearing in search results.

- Visuals: Use high-quality screenshots and engaging videos to showcase your app’s features. First impressions matter, especially in crowded app stores.

- Ratings and Reviews: Encourage early users to leave positive reviews. Apps with higher ratings are more likely to be downloaded by others, highlighting the importance of quality fintech app development.

Growing Your User Base

Launching your app is just the beginning. To build a thriving user base, you need to focus on both acquisition and retention. Here’s how to keep the momentum going:

Incentivize Referrals

Who doesn’t love a good referral? Incentivize referrals by offering rewards—think discounts, free features, or even cash—for users who bring in new customers.

Example: Remember how Dropbox exploded in popularity? They offered extra storage space for every successful referral. Your FinTech app can do something similar. Offer a free month of premium services for every friend referred. The more, the merrier!

Continuous Updates

No one likes a stale app. Continuous updates are crucial to keeping your app relevant and user-friendly.

- Bug Fixes: Regularly squash those pesky bugs. A smooth, glitch-free experience is essential for user satisfaction.

- New Features: Keep an eye on trends and user feedback. Introducing new features that users actually want is a surefire way to keep them engaged. This is where ongoing fintech app development plays a crucial role.

- Example: Think of your app like a favorite TV show—people will keep coming back if there’s always something new and exciting to watch.

Customer Support

Ever been frustrated by poor customer service? It’s a deal-breaker. That’s why excellent customer support is non-negotiable.

- Real-Time Support: Offer live chat or quick email responses to address user concerns. Prompt, helpful support can turn a negative experience into a positive one.

- User Feedback: Actively seek out and respond to user feedback. This shows users that you value their opinions and are committed to improving their experience.

- Example: Remember Zappos? Their legendary customer service is one of the reasons they became a billion-dollar company. Apply the same principles to your FinTech app, and watch your user base grow. With the right fintech app development and support, your app can reach new heights.

Launching and growing a FinTech app isn’t easy, but with the right strategies in place, you can set the stage for success. From a carefully planned launch to ongoing user engagement, every step matters.

Final Thoughts

To wrap things up, FinTech app development is a dynamic and rapidly growing field that offers immense opportunities for both users and businesses. As financial services continue to evolve, the need for innovative, user-friendly, and secure FinTech apps will only increase. Whether you’re an entrepreneur looking to disrupt the market or a business aiming to enhance customer engagement and streamline operations, investing in FinTech app development is a smart move.

By understanding the process—from idea validation to choosing the right FinTech app development company—you can create a successful app that meets the needs of modern consumers. With the right approach and a focus on user experience, security, and continuous improvement, your FinTech app can become a vital tool in the financial landscape of 2024 and beyond.

Hire FinTech App Developers to Elevate Your Financial Solutions

Having a cutting-edge FinTech app is essential to staying ahead of the competition. Whether you’re a startup looking to disrupt the market or an established financial institution aiming to offer enhanced digital services, hiring the right FinTech app developers can make all the difference.

At TechnBrains, we are a leading FinTech app development company that specializes in developing high-performance FinTech apps tailored to your unique business needs. Our team of skilled developers has deep expertise in the financial technology sector, ensuring your app is not only innovative but also secure, compliant, and user-friendly.

Why Choose TechnBrains for FinTech App Development?

Expertise in FinTech Mobile App Development: We understand the intricacies of financial services and are well-versed in the latest industry trends and regulations.

Custom FinTech App Solutions: We don’t believe in one-size-fits-all. Our developers create bespoke apps that align perfectly with your business goals.

Robust Security: Financial data security is our top priority. We implement advanced encryption and security protocols to protect your users and your business.

User-Centric Design: We design intuitive interfaces that offer seamless experiences, keeping your customers engaged and satisfied.

End-to-End Service: From idea validation to post-launch support, we handle every aspect of building a FinTech app so you can focus on what you do best.

Take the Next Step

Don’t let your FinTech app idea sit on the sidelines. Hire our expert FinTech app developers today and watch your vision come to life with TechnBrains.

As a top FinTech app development company, we’re ready to collaborate with you to create a game-changing app that sets you apart in the financial industry. Contact us now to start building a FinTech app that will set the standard in your sector!