Step into the future of finance with a tap of your finger! In a world where your smartphone becomes your bank, mobile wallet apps have taken center stage, offering secure and seamless transactions to make with your money.

Digital wallets, also known as eWallets or mWallets, have gained popularity as a quick and secure payment method. They offer an alternative to physical cards and cash, making transactions more efficient and secure. However, developing a mobile wallet app is a complex process that requires proper planning and understanding of mobile payment systems.

Before delving into the technical aspects, it’s crucial to comprehend the current financial landscape. TechnBrains’ insightful blog on Best Money-Making Apps sheds light on the diverse applications in the market, providing valuable insights into user preferences and emerging trends. This understanding forms the foundation for crafting a mobile wallet app that not only meets but exceeds user expectations.

In this article, we will show you how to build a mobile wallet app using a ready-made solution that can save you both time and resources. Don’t miss out on the convenience and security of a mobile wallet app – let’s get started!

What is a Mobile Wallet App?

A mobile wallet application serves as a digital platform empowering users to securely store, manage, and utilize their payment information for transactions via mobile devices. This transformative technology effectively converts a mobile device into a digital wallet, offering a secure repository for credit/debit card details, bank account information, and various payment methods. This functionality facilitates convenient payment processes, seamless money transfers, and efficient management of financial transactions.

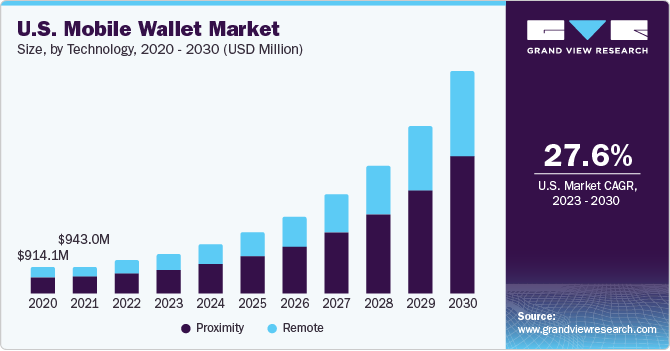

Mobile Wallet App Industry Overview

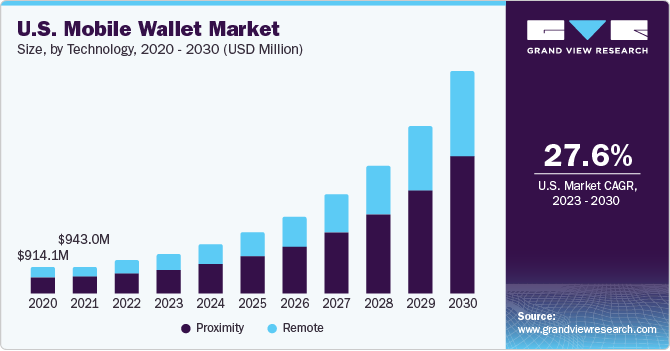

The mobile wallet app industry has experienced rapid growth, fueled by the increasing adoption of digital payments and the widespread use of mobile devices. Let’s look at some stats below:

- Mobile Wallet Market, valued at USD 318.5B in 2022, is expected to grow at 18.5% CAGR from 2023 to 2032 due to widespread smartphone and internet adoption.

- Retailers who integrate cashless or contactless payment technology with digital marketing can gain customer loyalty and data.

- Google Wallet expanded into Albania, Argentina, Bosnia and Herzegovina, North Macedonia, and Montenegro in June 2023.

Key Mobile Wallet Companies

The mobile wallet market stats were quite impressive. From seamless transactions to innovative features, these mobile wallet companies redefine the way we manage our finances in the digital age. Now, before diving into how to create a mobile wallet app, let us look at some of the best mobile wallet companies in the USA:

Amazon Web Services, Inc. (AWS)

Amazon Web Services (AWS) stands as a global leader in cloud computing services. Renowned for its expansive and reliable infrastructure, AWS offers scalable solutions that cater to diverse business needs. AWS provides cutting-edge AI and machine learning capabilities, empowering businesses to innovate and drive efficiency in their operations.

Visa Inc.

As a global payment technology company, Visa Inc. is synonymous with secure and convenient financial transactions. Its global network ensures swift and secure payments across borders. The Visa Token Service (VTS) is a standout feature, enhancing security by replacing sensitive card information with unique tokens reducing the risk of fraud.

American Express

American Express, a stalwart in the financial services industry, is renowned for its premium credit card offerings. Its Membership Rewards program, offering points for every purchase, is a distinctive feature that enhances customer loyalty. Additionally, the company’s focus on customer service and fraud protection contributes to its reputation for trustworthiness.

PayPal Holdings Inc.

PayPal Holdings has revolutionized online payments with its user-friendly platform. One notable feature is its robust buyer and seller protection policies, fostering trust in online transactions. Additionally, the integration of One Touch allows users to make seamless and secure purchases with a single touch, enhancing the user experience.

Apple Inc.

Apple Inc. is synonymous with innovation, and its Apple Pay service is no exception. The incorporation of Face ID and Touch ID for secure and convenient transactions showcases Apple’s commitment to user privacy and security. The seamless integration of Apple Pay across various Apple devices adds an extra layer of convenience.

Google Inc.

Google’s payment service, Google Pay, is recognized for its simplicity and versatility. The integration of Google Pay into various Google products streamlines the payment process. Furthermore, Google’s commitment to robust security measures, such as tokenization, enhances the trustworthiness of its payment services.

Mastercard

Mastercard‘s global payment network is synonymous with secure and swift transactions. The Priceless Cities program, offering exclusive experiences and discounts, enhances the overall customer experience. Mastercard’s commitment to advancing digital security through initiatives like the Cyber Resilience Institute contributes to its authority in the financial technology sector.

Alipay

Alipay, a leading mobile payment platform, has transformed the financial landscape in China. The integration of lifestyle features, such as social and entertainment functions, within the Alipay app creates a comprehensive and engaging user experience. Alipay’s adoption of advanced technologies like facial recognition adds an extra layer of security.

Samsung

Samsung Pay, a mobile payment service, sets itself apart with its Magnetic Secure Transmission (MST) technology, allowing users to make payments at traditional magnetic stripe card terminals. The integration of Samsung Knox, a defense-grade security platform, enhances the trustworthiness of Samsung Pay.

AT&T

AT&T, a telecommunications giant, has expanded its services to include mobile payments. AT&T’s feature of combining mobile plans with payment services provides users with a seamless and integrated experience. The company’s longstanding presence in the telecommunications industry contributes to its authoritative position in the evolving digital payments landscape.

In a world where mobile wallets lead the charge, these companies stand as pioneers. Whether you’re a seasoned user or just starting your digital financial journey, these key mobile wallet companies promise a future where your transactions are not just secure but effortlessly woven into your everyday life. Let us now explore how to create a mobile wallet app.

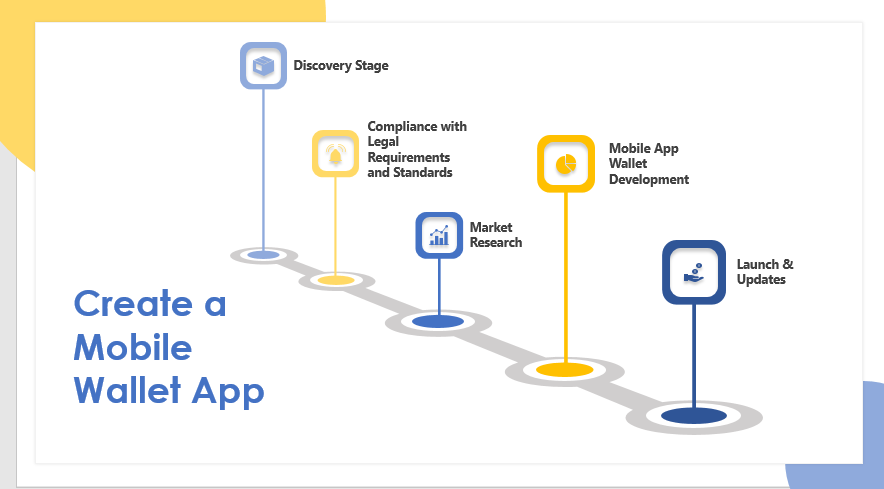

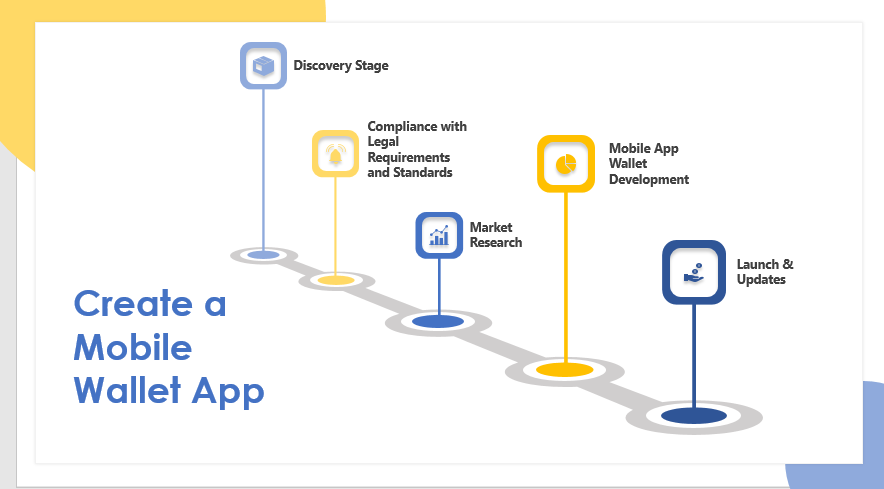

How to Create a Mobile Wallet App?

Developing a mobile wallet app is a classy undertaking that demands expertise in software development, security protocols, and financial systems. Follow these easy steps to make a mobile wallet app:

1. Discovery Stage

Clearly articulate the app’s purpose, objectives, and target audience during the discovery stage. This foundational step provides direction for the subsequent design and development phases.

2. Compliance with Legal Requirements and Standards

Uphold strict compliance with financial regulations, including Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. Additionally, ensure adherence to all pertinent local laws and regulations to bolster the app’s trustworthiness.

3. Market Research

Conduct thorough market research to comprehend the competitive landscape and user preferences. Incorporate essential features such as robust security measures and user-friendly interfaces based on the insights gained from comprehensive research.

4. Design Phase

Opt for a design approach, be it native or hybrid, and create wireframes and prototypes for user interface testing. Prioritize the user experience (UX) design to guarantee the app’s user-friendliness.

5. Development Phase

Collaborate on both front-end and back-end development, integrating key features while maintaining stringent security standards. Implement API-driven neobank software for enhanced functionality, ensuring the app aligns with E-A-T’s emphasis on expertise and trustworthiness.

6. Quality Assurance and Testing

Execute rigorous testing procedures, encompassing functional, security, and performance testing, to identify and rectify any bugs or issues. This commitment to quality aligns with E-A-T principles, establishing the app’s reliability.

7. Launch the Application

Plan and execute the app launch meticulously, taking into account effective marketing strategies and adherence to app store guidelines. A well-executed launch contributes to the app’s perceived authority and trustworthiness.

8. Ongoing Development and Support

Commit to continuous maintenance and updates, addressing any emerging bugs, updating features, and ensuring compatibility with new operating systems.

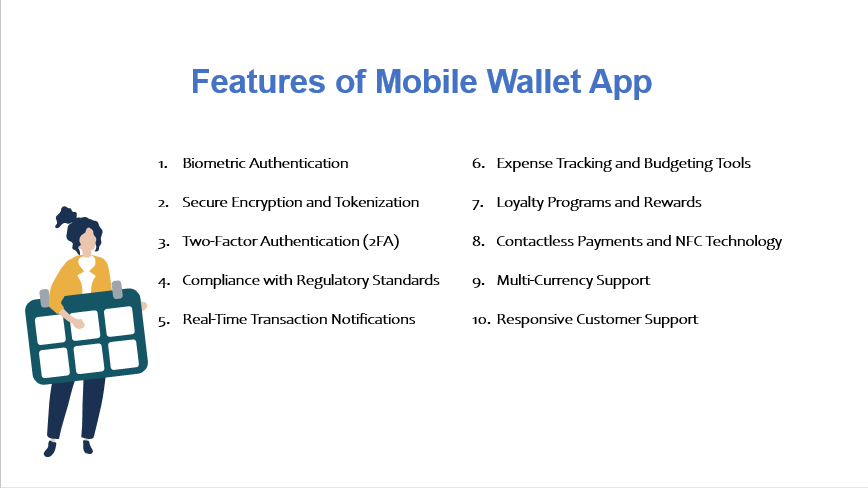

Must-Have Features for a Mobile Wallet App

Let’s delve into the must-have features for a mobile wallet app, ensuring not only functional excellence but also a trustworthy and secure user experience.

Biometric Authentication

Implement robust biometric authentication features such as fingerprint or face recognition. This not only enhances security but also provides a convenient and frictionless user experience.

Secure Encryption and Tokenization

Prioritize the security of user data by employing strong encryption protocols. Additionally, implement tokenization to replace sensitive data like credit card details with unique identifiers, ensuring heightened protection against potential breaches.

Two-factor authentication (2FA)

Strengthen account security with two-factor authentication. This additional layer of verification adds an extra barrier against unauthorized access, bolstering user confidence in the app’s security measures.

Compliance with Regulatory Standards

Adhere to financial regulations such as Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. Compliance with these standards not only establishes the app’s credibility but also ensures legal and ethical operations.

Real-Time Transaction Notifications

Keep users informed with real-time transaction notifications. This transparency not only enhances the user experience but also builds trust by providing users with immediate updates on their financial activities.

Expense Tracking and Budgeting Tools

Integrate features that allow users to track their expenses and manage budgets within the app. Providing financial insights empowers users to make informed decisions, reinforcing the app’s utility beyond simple transactions.

Loyalty Programs and Rewards

Lift user engagement by incorporating loyalty programs and reward systems. Encourage users to stay within the ecosystem by offering incentives, discounts, or cashback, fostering a sense of loyalty.

Contactless Payments and NFC Technology

Stay ahead of technological trends by incorporating contactless payment options and Near Field Communication (NFC) technology. This not only aligns with modern payment preferences but also positions the app as forward-thinking and innovative.

Multi-Currency Support

Cater to a diverse user base by providing support for multiple currencies. This feature is especially crucial for users engaged in international transactions, ensuring a seamless and inclusive experience.

Responsive Customer Support

Bolster the app’s trustworthiness with responsive customer support. Incorporate chat support, FAQs, and a helpline to address user queries promptly, showcasing a commitment to user satisfaction and assistance.

By integrating these features, a mobile wallet app not only meets the functional needs of users but also establishes itself as an authoritative and trustworthy financial tool.

How Much Does It Cost to Develop A Digital Wallet App?

In 2024, the landscape of custom software development costs is evolving. TechnBrains provides a forward-looking perspective in their blog on Custom Software Development Costs in 2024. Incorporating this knowledge will empower you to make informed decisions, ensuring that your mobile wallet app development stays within budget without compromising on quality.

The cost of developing a digital wallet app can vary based on a variety of factors, such as the features and functionalities that it offers, the location of the digital wallet app development agency, the type of app, and more. To get a better understanding of the cost of developing your digital wallet app, it’s important to evaluate these factors:

- The platform on which your app will be running.

- The features and functionalities that your eWallet will provide to its users.

- The technology stack and the tools that will be used to build the application.

- The testing stage of the app and the level of maintenance it requires.

- The location of your mobile wallet development company.

The cost of developing an eWallet app usually falls between $50,000 to $100,000 or even more for advanced features. Suppose you want a more accurate estimate of the cost of developing a mobile wallet app. In that case, we can discuss the critical features of a digital wallet app that significantly affect the overall development cost.

Build a Mobile Wallet App with TechnBrains

Developing a mobile wallet app requires a significant investment of time, resources, and expertise. Understanding API development is a crucial aspect of building a robust mobile wallet app. TechnBrains offers a comprehensive guide on API Development, which serves as an invaluable resource for businesses. By following the steps outlined in this guide and leveraging TechnBrains’ expertise, businesses can expedite the development process and launch a high-quality mobile wallet app that caters to the needs of their target audience.